About

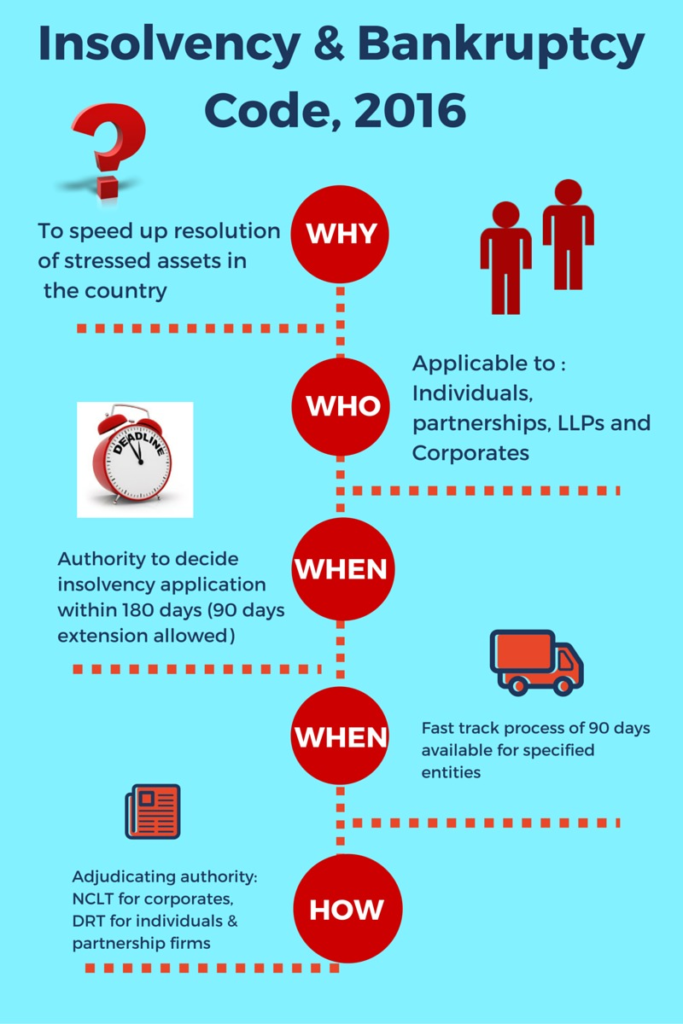

- The Insolvency and Bankruptcy Code (IBC), 2016 is the bankruptcy law of India that consolidates and amends the existing laws relating to insolvency and bankruptcy of corporate persons, partnership firms, and individuals.

- Insolvency is a state where the liabilities of an individual or an organization exceed its assets and that entity is unable to raise enough cash to meet its obligations or debts as they become due for payment.

- Bankruptcy is when a person or company is legally declared incapable of paying their due and payable bills.

- The IBC aims to provide a time-bound and creditor-driven process for insolvency resolution and to improve the credit culture and business environment in the country.

- IBC resolves claims involving insolvent companies. This was intended to tackle the bad loan problems that were affecting the banking system.

Regulating Authority of Insolvency and Bankruptcy Code

- The Insolvency and Bankruptcy Board of India (IBBI) was established under the Insolvency and Bankruptcy Code, of 2016.

- It is a statutory body, responsible for making and implementing rules and regulations for insolvency and bankruptcy resolution of corporate persons, partnership firms, and individuals in India.

- The IBBI has 10 members, representing the Ministry of Finance, the Ministry of Corporate Affairs, and the Reserve Bank of India.

Adjudicating Authority

- National Company Law Tribunal (NCLT) has jurisdiction over companies and other limited liability entities.

- Debt Recovery Tribunal (DRT) has jurisdiction over individuals and partnership firms other than Limited Liability Partnerships.

Amendments in the IBC

- The IBC has undergone significant amendments in the past 12 months to address emerging challenges and enhance its effectiveness.

- These amendments include the approval for the sale of assets or resolution plans on a segregated basis, an increase in the number of NCLT benches to 16, and extended timelines for filing claims.

- Sector-specific amendments, provisions for the audit of corporate debtors, and modifications in Form G2 have been introduced to address unique challenges.

Achievements

- Since its inception in 2016, IBC has resolved Rs. 3.16 lakh crore of debt stuck in 808 cases in seven years, according to CRISIL.

- It has resolved a significant amount of stressed assets with better recovery rates compared to previous mechanisms like the Debt Recovery Tribunal, the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, and Lok Adalat.

- IBC has achieved higher recovery rates, with creditors realizing 32% of admitted claims on average and 169% of the liquidation value.

- In contrast, other mechanisms had recovery rates ranging from 5-20%.

- IBC’s deterrent effect is evident as borrowers, fearing the loss of companies, have proactively settled over Rs. 9 lakh crore in debt before cases entered the insolvency process.

- This highlights a significant behavioral change among borrowers, showcasing the efficacy of the Insolvency and Bankruptcy Code in encouraging timely settlements.

Challenges/Issues of IBC

Low Repayment Percentage

- The resolution plan approval process typically involves only about 15% payment by the purchaser, and repayment can take years without any further interest collected by the banks according to the financial stability report (FSR) released by the Reserve Bank of India (RBI) in 2023.

- This has raised questions about the effectiveness of the repayment process.

Settlement and Recovery

- Recent settlements and resolutions, such as the Reliance Communications Infrastructure Ltd. (RCIL) case, have raised concerns due to the low settlement amounts and extended resolution periods.

- For example, the settlement for RCIL amounted to a mere 0.92% of the debt, and it took four years to complete the resolution plan, far beyond the stipulated maximum of 330 days.

- The Financial Creditors (FCs) should ideally get principal and interest.

- Time-consuming processes for identifying and acknowledging defaults contribute to reduced recovery rates. It hampers the timely initiation of resolution proceedings, contributing to reduced recovery rates.

Haircuts and Recovery Rates

- The concept of “haircuts,” which involves writing off loans and accrued interest, has gained prominence.

- Promoters are taking advantage by taking the company to cleaners and getting a substantial haircut from bankers/National Company Law Tribunal (NCLT).

- After resolutions, borrowers and Insolvency Professionals (IPs) remain wealthy, while lenders suffer and banks are absolved from liability, as only companies are declared insolvent, not the owners, leading to depositors being the losers.

- This has resulted in low recovery rates for financial creditors, with some cases realizing as little as 5% of the loan outstanding.

Realizable Value

- The FSR released by the RBI in 2023 highlights the low realizable value to creditors, with banks or financial creditors recovering an average of just 10-15% in NCLT-settled cases of large corporates. However, the RBI says the creditors realize 168.5% of the liquidation value and 86.3% of the fair value.

- As per the FSR, out of 597 liquidations, against the claim of Rs 1,32,888 crore, the amount realised was 3% of the claims admitted.

- While banks collect up-to-date interest on loans to farmers, students, MSMEs, and on housing, including penalty interest for delays, corporates are treated differently.

- The amount realized from liquidations has also been minimal, raising concerns about the recovery process.

Regulatory Concerns

Regulatory Reports:

- The FSR has highlighted several concerns regarding the Corporate Insolvency Process (CIRP).

- The report indicates that the admitted claims are less than the dues, and banks or financial creditors are recovering only a fraction of the liquidation value and fair value.