About

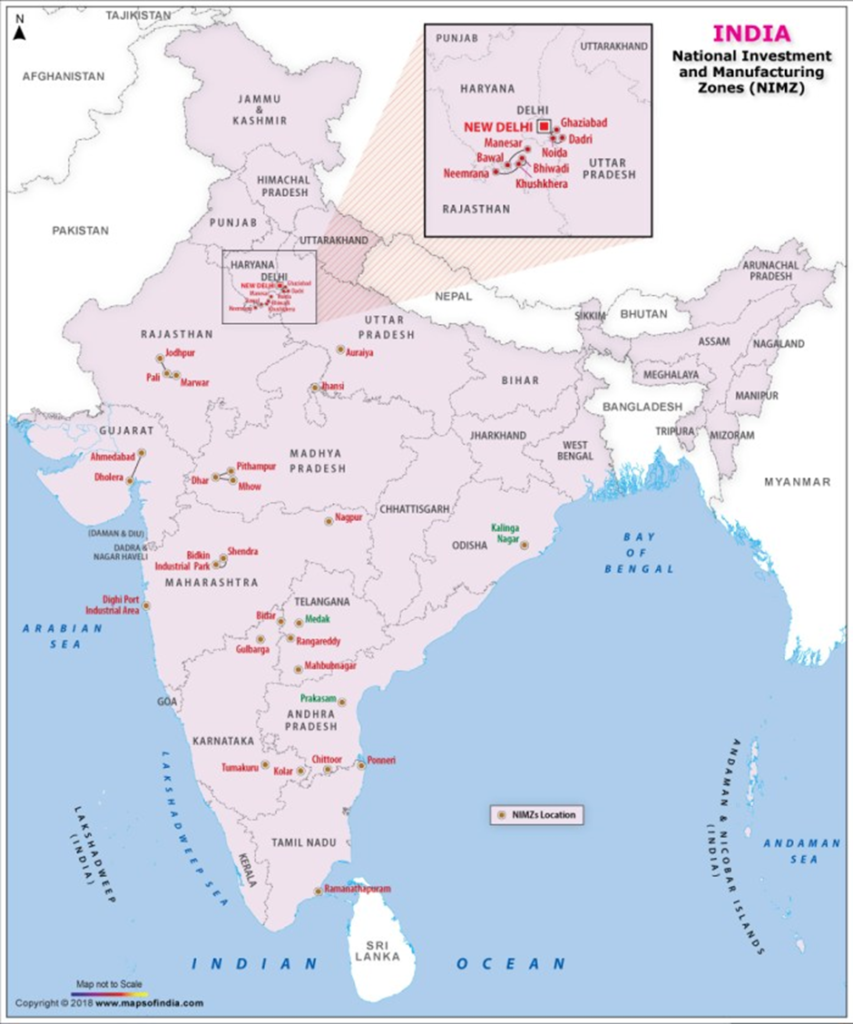

- NIMZ stands for National Investment and Manufacturing Zones. These are special areas in India that aim to attract investments and promote manufacturing. They provide good infrastructure and support for businesses.

- The National Investment and Manufacturing Zones Authority (NIMZA) is the regulatory body for NIMZs.

- NIMZs are different from Special Economic Zones (SEZs), which have their own goals and benefits. NIMZs are regulated by specific organizations that plan and manage them.

- They are industrial townships developed by the Government of India.

- NIMZs are designed to provide a conducive environment for businesses to operate. This includes world-class infrastructure, skilled labor, and access to markets.

- The National Investment and Manufacturing Zone in India is governed by the National Investment and Manufacturing Zones Act 2000.

- The Ministry of Commerce and Industry is the nodal ministry for NIMZs.

Focus Areas of NIMZ

- To provide a conducive environment for businesses to operate.

- To attract investment from domestic and foreign companies.

- To create jobs and boost economic growth.

How does NIMZ Work?

- NIMZs are developed by GoI in partnership with state governments and private sector firms.

- The government provides land, infrastructure, and other facilities.

- The private sector companies invest in the development of the zone.

- They offer various incentives and facilitations to attract investments.

- This includes tax benefits, simplified regulatory procedures, and access to a skilled workforce.

- NIMZs provide a comprehensive ecosystem that promotes economic development in the designated regions.

- The NIMZs are envisaged as integrated industrial townships with state-of-the-art infrastructure, land use based on zoning, clean and energy-efficient technology, necessary social infrastructure, skill development facilities, etc. to promote world-class manufacturing activities.

- At least 30% of the total land area proposed for the NIMZ will be utilized for the location of manufacturing units.

- The land for these zones will preferably be waste infertile not suitable for cultivation, not in the vicinity of any ecologically fragile area, and with reasonable access to basic resources.

- On receipt of final approval, the NIMZ will be declared by the State Government as an industrial township under Article 243Q(1)(c) of the Constitution.

- The central government provides external physical infrastructure linkages to the NIMZs including rail, road, ports, airports, and telecom, in a time-bound manner and also provides viability gap funding wherever required.

- The State Government will constitute a Special Purpose Vehicle (SPV) to discharge the functions specified in the policy.

- The SPV will prepare a strategy for the development of the zone and an action plan for self-regulation to serve the purpose of the policy.

- The Department for Promotion of Industry and Internal Trade (former DIPP) is the nodal agency for NIMZ.

Difference between SEZ (Special Economic Zones) and NIMZ

| BASIS OF DIFFERENCE | NIMZ | SEZ |

| Legislative Backing | Under the National Manufacturing Policy (NMP) in 2011 | Under the Special Economic Zones Act, 2005 |

| Minimum Area | 5000 hectares | 10-1000 hectares (depending on the sector) |

| Maximum Area | Not Specified | 5000 hectares |

| Income tax exemption | To small and medium enterprises | 100% for the first 5 years, 50% for the next five years |

| Environmental Impact Assessment | Provided by the state government | By the project developer |