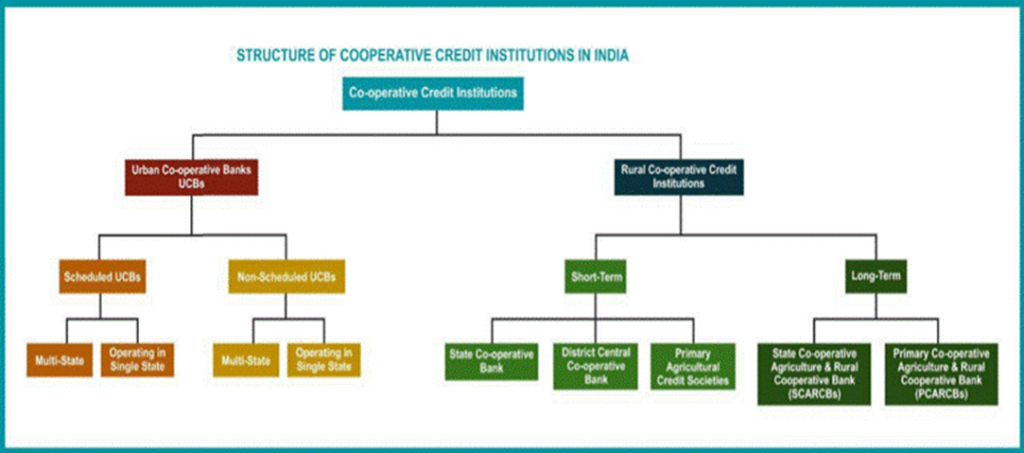

- Primary Agricultural Credit Society is the grassroots-level arm of the short-term cooperative credit structure.

- PACs deal directly with the rural (agricultural) borrowers, give those loans, and collect repayments of loans given. and also undertake distribution and marketing functions.

- They occupy a predominant position in the cooperative credit structure and form its base.

- It serves as the final link between the ultimate borrowers on the one hand and the higher financing agencies, namely the Scheduled Commercial Banks, and the RBI/NABARD on the other hand.

Significance of PACS:

Access to Credit:

PACS provides small farmers with access to credit, which they can use to purchase seeds, fertilizers, and other inputs for their farms. This helps them to improve their production and increase their income.

Financial Inclusion:

PACS help to increase financial inclusion in rural areas, where access to formal financial services is limited. They provide basic banking services, such as savings and loan accounts, to farmers who may not have access to formal banking services.

Convenient Services:

- PACS are often located in rural areas, which makes it convenient for farmers to access their services. This is important because many farmers are unable to travel to banks in urban areas to access financial services.

- PACS have the capacity to extend credit with minimal paperwork within a short time.

Promoting Savings Culture:

PACS encourages farmers to save money, which can be used to improve their livelihoods and invest in their farms.

Enhancing Credit Discipline:

PACS promotes credit discipline among farmers by requiring them to repay their loans on time. This helps to reduce the risk of default, which can be a major challenge in the rural financial sector.

Organisational Structure of PACS

- General Body of PACS: Exercise the control over board as well as management.

- Management Committee: Elected by the general body to perform the work as prescribed by the society’s rules, acts, and by-laws.

- Chairman, Vice-Chairman, and Secretary: Work for the benefit of the members by performing their roles and duties as assigned to them.

- Office Staff: Responsible for performing day-to-day work.

Issues with PACS:

- Inadequate Coverage: Coverage is low in some areas, especially in the north-east. Only 50% of rural households are covered as members.

- Inadequate Resources: PACS resources are insufficient for the short- and medium-term credit needs of the rural economy.

- Overdue and NPAs: RBI reports lending of Rs 1,43,044 crore and NPAs of Rs 72,550 crore. Overdue hamper the circulation of loanable funds, diminish borrowing and lending power, and tarnish the image of societies.